Cryptocurrency Exchange Platforms: Everything You Need to Know!

Introduction to Cryptocurrency Exchange Platforms

Cryptocurrency exchange platforms have become integral components of the digital economy, facilitating the buying, selling, and trading of various cryptocurrencies. As the popularity of cryptocurrencies continues to rise, understanding the role and functionality of these exchange platforms becomes increasingly important.

What are Cryptocurrency Exchange Platforms?

Cryptocurrency exchange platforms are online platforms that allow users to exchange their digital assets, such as Bitcoin, Ethereum, and other cryptocurrencies, for other digital assets or fiat currencies. These platforms serve as intermediaries, matching buyers and sellers and facilitating transactions securely and efficiently.

Key features of cryptocurrency exchange platforms include order books, which display all current buy and sell orders, and trading charts, which provide historical price data and analysis tools to help users make informed trading decisions.

Types of Cryptocurrency Exchange Platforms

There are three main types of cryptocurrency exchange platforms: centralized exchanges, decentralized exchanges, and hybrid exchanges.

Centralized exchanges are operated by a central authority and require users to deposit their funds into the exchange's wallets. These exchanges offer high liquidity and a wide range of trading pairs but may be vulnerable to hacking or regulatory scrutiny.

Decentralized exchanges, on the other hand, operate on a peer-to-peer basis, allowing users to trade directly with each other without the need for a central authority. These exchanges offer greater security and privacy but may suffer from lower liquidity and limited trading pairs.

Hybrid exchanges combine the features of centralized and decentralized exchanges, offering the security and privacy of decentralized exchanges with the liquidity and trading options of centralized exchanges.

How Cryptocurrency Exchange Platforms Work

Cryptocurrency exchange platforms have become integral to the functioning of the digital currency market. These platforms facilitate the buying, selling, and trading of various cryptocurrencies. Understanding how cryptocurrency exchange platforms work is crucial for anyone interested in participating in the crypto market.

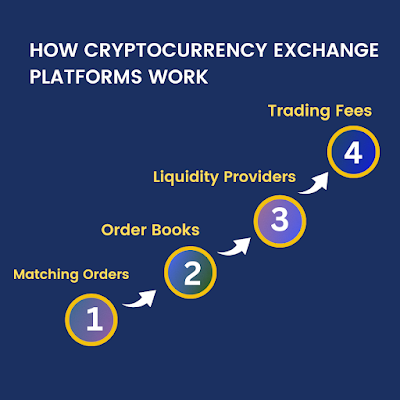

Matching Orders

At the core of cryptocurrency exchanges is the matching of buy and sell orders. When a user places an order to buy or sell a cryptocurrency, the exchange matches that order with a corresponding order from another user. This matching process ensures that transactions can occur seamlessly and efficiently.

Order Books

Order books play a vital role in the functioning of cryptocurrency exchanges. An order book is a list of all pending buy and sell orders for a particular cryptocurrency. It displays the price and quantity of each order, allowing users to see the current market demand and supply dynamics.

Liquidity Providers

Liquidity is essential for the smooth operation of cryptocurrency exchanges. Liquidity providers are individuals or entities that contribute funds to the exchange, ensuring enough buyers and sellers to facilitate trades. Market makers, for example, help maintain liquidity by continuously placing buy and sell orders.

Trading Fees

Cryptocurrency exchanges generate revenue through trading fees. When users execute trades on the platform, they are charged a fee based on the transaction volume. These fees can vary depending on factors such as the exchange's fee structure and the user's trading volume.

Security Measures in Cryptocurrency Exchanges

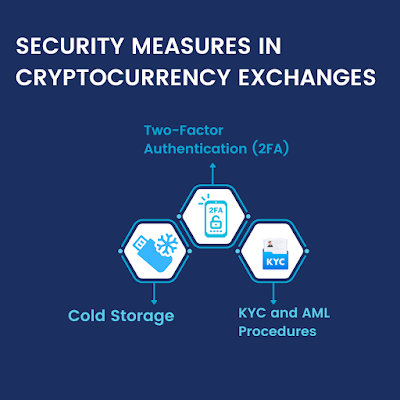

Security is a top priority for cryptocurrency exchanges due to the potential for hacking and theft. Exchanges employ various security measures to protect users' funds and personal information. Some common security measures include:

Cold Storage

Many exchanges store the majority of their users' funds in offline storage, known as cold storage. This helps mitigate the risk of hacking since the funds are not connected to the internet.

Two-factor authentication (2FA)

Two-factor authentication adds an extra layer of security to user accounts by requiring them to provide two forms of verification before logging in or executing trades.

KYC and AML Procedures

To comply with regulatory requirements and prevent money laundering and fraud, exchanges often implement Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures. These measures help verify the identities of users and monitor their transactions for suspicious activity.

User Interface and Experience

The user interface of a cryptocurrency exchange plays a significant role in attracting and retaining users. A well-designed interface should be intuitive and easy to navigate, allowing users to execute trades quickly and efficiently.

Registration and Verification

To start trading on a cryptocurrency exchange, users typically need to register an account and verify their identity. This process may involve providing personal information and documentation to comply with KYC and AML regulations.

Trading Interface

The trading interface is where users can view market data, place orders, and monitor their portfolios. A good trading interface should provide real-time price updates, advanced charting tools, and order execution options.

Deposit and Withdrawal Process

Depositing and withdrawing funds from a cryptocurrency exchange should be a seamless process. Users should have multiple options for funding their accounts, such as bank transfers, credit/debit cards, and cryptocurrency deposits. Withdrawals should also be processed quickly and securely.

Regulations and Compliance

Regulatory compliance is a significant concern for cryptocurrency exchanges, as they operate in a rapidly evolving regulatory landscape. Exchanges must adhere to government regulations and comply with industry standards to ensure the legality and legitimacy of their operations.

Government Regulations

Cryptocurrency exchanges are subject to regulation by government authorities in various jurisdictions. Regulatory requirements may include obtaining licenses, adhering to reporting obligations, and implementing consumer protection measures.

Compliance Standards

In addition to government regulations, cryptocurrency exchanges must also comply with industry standards and best practices. Compliance frameworks such as the Financial Action Task Force (FATF) guidelines help exchanges establish robust anti-money laundering and counter-terrorism financing controls.

Cryptocurrency Exchange Business Models

Cryptocurrency exchanges employ various business models to generate revenue and sustain their operations. In addition to trading fees, exchanges may generate income through listing fees, premium services, and other revenue streams.

Trading Fees

Trading fees are the primary source of revenue for most cryptocurrency exchanges. Exchanges typically charge a small percentage of the transaction volume as a fee for executing trades on their platform.

Listing Fees

Some exchanges charge fees for listing new cryptocurrencies on their platform. Listing fees can vary depending on factors such as the popularity and demand for the cryptocurrency.

Premium Services

To attract high-volume traders and institutional investors, some exchanges offer premium services such as margin trading, futures contracts, and over-the-counter (OTC) trading. These services often come with additional fees or subscription charges.

Risks Associated with Cryptocurrency Exchange Platforms

While cryptocurrency exchanges offer profit opportunities, they also pose significant risks for users. Understanding these risks is essential for making informed investment decisions and protecting one's assets.

Market Volatility

The cryptocurrency market is highly volatile, with prices fluctuating dramatically in short periods. Sudden price swings can result in significant gains or losses for traders, depending on their positions.

Hacking and Security Breaches

Cryptocurrency exchanges are frequent targets for hackers due to the large amounts of digital assets they hold. Security breaches can lead to the theft of users' funds and personal information, causing financial losses and reputational damage to the exchange.

Regulatory Risks

Regulatory uncertainty is a persistent risk factor in the cryptocurrency industry. Changes in government regulations and policies can impact the legality and operations of cryptocurrency exchanges, affecting their ability to serve customers and operate profitably.

Evolution of Cryptocurrency Exchanges

Cryptocurrency exchanges continue to evolve in response to technological advancements and market demand. Two notable trends shaping the future of exchanges are the rise of decentralized exchanges (DEX) and peer-to-peer (P2P) platforms.

Decentralized Exchanges (DEX)

Decentralized exchanges operate without a central authority or intermediary, allowing users to trade directly with each other using smart contracts. DEXs offer increased security and privacy compared to centralized exchanges but may have lower liquidity and trading volumes.

Peer-to-Peer (P2P) Platforms

Peer-to-peer (P2P) platforms are decentralized networks that allow individuals to interact directly with one another, without the need for intermediaries. These platforms facilitate transactions, communication, and resource sharing among users, fostering a sense of community and trust.

How Wisewaytec Will Help You in Developing Cryptocurrency Exchange Platforms

Cryptocurrency exchange platforms have become integral in the digital economy, facilitating the exchange of various cryptocurrencies seamlessly. As the demand for such platforms surges, the need for reliable Crypto exchange companies is important. Wisewaytec stands out as a leading cryptocurrency exchange development company, offering comprehensive services tailored to meet the unique requirements of developing cryptocurrency exchange platforms.

.png)

Comments